Attention Landlords

Are You Aware Of The New EPC Rules And How They Affect You?

As of the 1st April 2023, it is now unlawful for private landlords to let a commercial or residential property with an Energy Performance Certificate (EPC) rating of less than an E. With further changes to follow in 2025, it is important that landlords are aware of the steps they need to take in order to continue letting their properties.

Current EPC Regulations

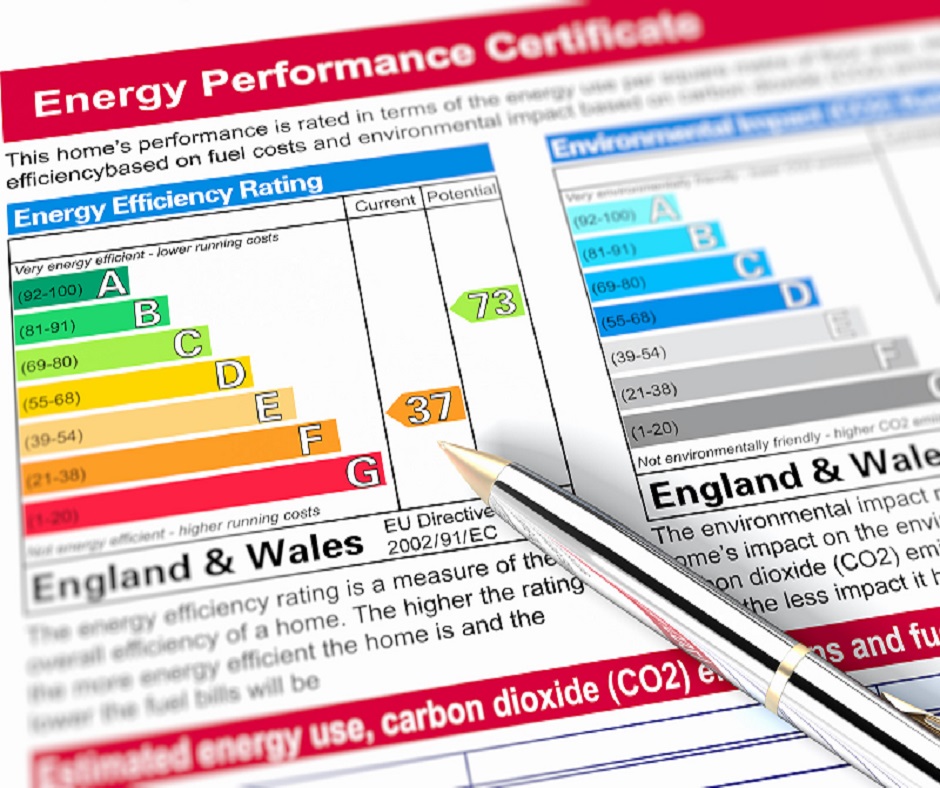

Since 2015, the Minimum Energy Efficiency Standards (MEES) have determined that private rented property in England and Wales must meet certain EPC rating standards. Valid for a 10 year period, an EPC is a measurable way of assigning an energy efficiency rating to a property, the most efficient being ‘A’ and the least efficient being ‘G’. In doing so, landlords and tenants are able to clearly understand and manage the energy performance of their property.

Currently, the required EPC rating for all private rental properties is E or above. Any property with a rating below this is considered ‘substandard’. If landlords defy the new requirements by continuing to let out a substandard property, they could be fined up to £150,000.

Why Energy Efficiency Is Important

A good EPC rating can result in lower energy bills and a reduced carbon footprint, making your property more attractive to prospective tenants. Improving the energy efficiency of your property can also decrease the overall cost of running your property, potentially increasing its value and lowering monthly maintenance and utility bill expenses.

New Changes To EPC Regulations

As part of the UK’s ambition to achieve net zero status by 2050, the EPC requirements are set to change again in 2025. From this point onwards, all newly rented properties will be required to have an EPC rating of C or above. Landlords with existing tenancies will have until 2028 to comply with the new EPC regulations.

If a landlord is suspected to be in breach of the new EPC regulations, the local authority can issue them with a compliance notice. Following an investigation confirming a breach in EPC standards, landlords could then be issued with a fine of up to £30,000.

Failure to meet the necessary MEES regulations may also cause further issues when trying to sell the property in the future. This is because all properties that are sold, rented or built are required to produce a valid EPC rating to accompany the property. Properties with a substandard EPC rating could become unrentable, unmortgageable and therefore undesirable to prospective buyers. With the 2025 deadline looming, it is important that landlords act now to prevent future difficulty.

What Landlords Should Be Doing Now

Landlords should be assessing their property portfolio to identify any properties with EPC ratings which fall below the 2025 mandatory rating of C. Once recognised, landlords must then complete property renovation works to improve the property’s energy efficiency in line with the new requirements.

Although the type and intensity of work needed may vary, the predicted cost incurred to increase the efficiency of a property from E to C rating is £29,289*. With the cost of living crisis already impacting landlords and tenants alike, landlords may struggle to afford property improvements without some financial assistance. Most landlords will resort to additional borrowing or remortgaging to afford works on their property, although some may already have savings set aside to cover these costs.

Why Landlords Should Speak With A Financial Advisor

If you are a landlord in need of property improvements, speaking with a financial advisor may provide you with some clarity about the next steps. Working closely with you to determine your short-term and long-term financial objectives, a professional financial advisor will create a bespoke plan to achieve your financial goals.

When considering how to make your property more energy efficient in line with the new EPC regulations, your financial advisor can assess your personal circumstances to determine whether remortgaging or additional borrowing are suitable for you. A reputable financial advisor will have access to an extensive range of market products, recommending the most appropriate products and rates to meet your specific circumstances.

By seeking advice from an independent financial advisor, you are relinquishing all concerns to an industry expert who can assist you with your personal and financial goals. They will offer unbiased, impartial advice to help you plan how to finance any necessary renovations to improve your property’s EPC rating.

Practical Changes To Improve Energy Efficiency

Some common practical renovations that can improve energy efficiency include replacing single-glazed windows with double or triple-glazed windows, adding wall and loft insulation and upgrading an old boiler for a newer, condensed version.

If landlords are unsure of what property improvements are required to increase energy efficiency, external property surveyors, such as domestic energy assessors (DEAs), can conduct an assessment of the property. Following the examination, the professionals will then calculate EPC ratings and recommend appropriate adjustments to improve energy efficiency.

Circumstances Where Landlords Could Be Exempt

If your property meets certain criteria, it is possible to apply for a 5 year exemption from EPC rating regulations.

One such exemption is if the landlord is unable to obtain permission from the tenant or another third-party member to complete the necessary works. Additionally, if the proposed renovation work is deemed by a quantity surveyor to damage or devalue the property, then landlords can apply for an exemption. From 2025 onwards, landlords can also apply for an exemption if the cost of the work needed to meet the new EPC requirements exceeds £10,000. Furthermore, new landlords will automatically have a temporary 6 month exemption from meeting the EPC requirements.

Financial Guidance You Can Trust

If you are the landlord of a property with an EPC rating of less than C, contact Rosewood today to speak with our friendly independent financial advisors. After assessing your specific circumstances, we will then create a personalised financial plan to facilitate any property renovation works to improve EPC ratings before the relevant 2025 or 2028 deadline. Our expert advisors are here to answer your wealth management questions and to support you throughout your property investment journey.

*Knight Frank Finance, 2022.

CONTACT DETAILS

Rosewood Wealth Management Ltd

United Kingdom (UK)

Phone: 01246 932300

Email: info@rosewoodwealth.co.uk

Registered in England and Wales Registered Company Number : 08291755. Registered address: 4th Floor, 1 Waterside Place, Basin Square, Brimington Road, Chesterfield, Derbyshire, S41 7FH.

Directors: Donna Robertson & Shannan Pool-Gorman

OPENING HOURS

What to do if you have a complaint: If you have a complaint or dispute with us, you are entitled to make a complaint. We have a complaints procedure that is available on request. If you wish to register a complaint, please contact us either in writing, by telephone or email. If you wish to register a complaint, please contact us: In writing: Shannan Pool-Gorman, 4th Floor, 1 Waterside Place, Basin Square, Brimington Road, Chesterfield, Derbyshire, S41 7FH. Email: info@rosewoodwealth.co.uk, or by telephone 01246 932300. Please be assured we treat complaints seriously. For your protection, if you cannot settle your complaint with us, you may be entitled to refer it to the Financial Ombudsman Service (‘FOS’). Please see the following link for further details: http://financial-ombudsman.org.uk/.

A lifetime mortgage is secured against your home and is a complex product. To understand the features and risks, ask for a personalised illustration. Your home or property may be repossessed if you do not keep up the repayments on your mortgage. You may have to pay an early repayment charge to your existing lender if you remortgage. The value of your investment can go down as well as up and you may not get back the full amount invested. Accessing pension benefits early may impact on levels of retirement income and your entitlement to certain means-tested benefits. Accessing pension benefits is not suitable for everyone. You should seek advice to understand your options at retirement.

© 2019 Rosewood Wealth Management | Rosewood Wealth Management is a trading style of Rosewood Wealth Management Ltd which is Authorised and Regulated by the Financial Conduct Authority – number: 841587. You can check this on the Financial Services Register by visiting the FCA’s website – or by contacting the FCA on 0800 111 6768. The Financial Conduct Authority does not regulate taxation advice, university/school fees planning some aspects of buy to let mortgages. The guidance and/or advice contained within the website is subject to the UK regulatory regime and is therefore primarily targeted at customers in the UK. The FCA’s consumer website address can be found here.